What are war bonds? War bonds are a way of raising money to fight a war from the citizens of that country, and a way of keeping inflation under control. The first public war bonds were issued during World War 1. Without them, both of the wars might have been lost.

Despite the technological advances that come about due to war, wars are obviously not good. There is an enormous loss of life, a disruption to society, and a tremendous financial cost. As we’re talking about war bonds, I’m only going to look at the financial cost and that is obviously almost impossible to calculate. You can work out how much was spent on weapons, supplies, and all the trappings of the military. You can probably work out how much it costs to rebuild as well. However, it is very difficult to work out all of the other costs, such as loss of a labor force and having to switch to a wartime economy and back again, along with numerous other hidden costs. Still, experts estimate that World War 1 cost $500 billion (in 2024 dollars) and World War 1 cost $4 trillion. World War 1 cost more because it was a truly worldwide war and there was more available technology, which obviously cost a lot of money. More money was plugged into research and development as well because the more technologically advanced side had an advantage. The Manhattan Project alone cost about $30 billion in today’s money.

This huge expense was not easy to bear. The UK spent almost half of its GDP on World War 1 and that is not something a country can afford to do. It might be survivable if it is just for a very short time, but if it has to be sustained over several years, which was the case with both world wars, it is not possible. All participants in the war still have to keep basic services going in their respective countries and find the extra money on top of that. People will sacrifice in times of war, but only to a point. So, how can countries afford to fight a war? War bonds is one solution.

A large part of a country’s money is held by private citizens in savings. During a war, governments use all the available money they have, but they need to access the money held by private citizens. War bonds are a way to do this. Governments often issues bonds. If you buy a bond, you a kind of buying a share in the government. You lend the government some money, for a decided number of years, on the understanding that the government will pay back the money, plus some interest, when the bond matures. Bonds are popular because they are generally safer than companies because the chance of a country collapsing and not being able to pay back a bond is low. War bonds are similar in principle, but they don’t offer interest. War bonds are sold at a discount on their face value. For example, you would buy a $100 war bond at $75 for an agreed period of ten years. After the ten years are up, you can sell the bond back to the government for $100, making a $25 profit. Although, because of inflation, your bond will lose value.

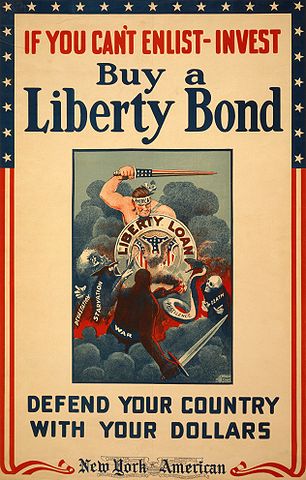

War bonds are a great way for a government to make money, but they are not such a good financial choice for the people buying them. Because they don’t pay interest, people end up making a lot less than market value. They don’t lose money, but they don’t make a lot. That means the government has to work really hard to sell them and they often try to persuade people on patriotic grounds. “You are not fighting in the war, so what can you do? Buy war bonds and help the troops.” War bonds not only raise money, they can increase the morale of the civilian population and make them more patriotic.

War bonds have a second motive as well. They keep inflation down. When people buy war bonds, money that was in the economy becomes centralized in the government and the overall amount of available money for people goes down. During a war, there are more jobs and more money is created because of the war effort. This can cause inflation, which will drive prices up, making life harder for people. This is not a good situation and war bonds keep money out of circulation, pushing inflation back down. If people don’t have as much money, they can’t buy as many things, and prices won’t go up.

Wars have always been expensive, but governments only started borrowing money from their citizens in World War 1. Austria-Hungary was the first country to try it. Before that, governments used to borrow money from wealthy people that could afford to lend it, such as the Rothchilds. However, this would be extremely costly and give a few people a lot of power. War bonds are a far better idea. And this is what I learned today.

Try these:

Sources

https://www.investopedia.com/terms/w/warbonds.asp

https://www.iwm.org.uk/history/how-children-helped-pay-for-both-world-wars

https://en.wikipedia.org/wiki/War_bond

https://www.nber.org/digest/jan05/economics-world-war-i

Image By Winsor McCay – Library of Congress – http://hdl.loc.gov/loc.pnp/cph.3g09888, Public Domain, https://commons.wikimedia.org/w/index.php?curid=883628

Pingback: Why are some materials brittle?