What is a Ponzi scheme? It is a type of fraud where you use money invested by new people to pay profits to the people who are already invested. It was named after Charles Ponzi who certainly didn’t invent the scheme but who made it famous.

(Incidentally, Ponzi scheme, scam, and con are all relatively recent words. Ponzi scheme was first used in 1957, scam in 1963, and con is the earliest, coming from 1889. I wonder what happened to make words like this appear in the last century and a bit.)

A Ponzi scheme is a type of financial scam or confidence trick. This is how it works. The founder of the scheme, let’s call him Bernie, tells several of his friends that he has a great investment idea that will return enormous amounts of money with almost no risk. His friends love the idea and they all give Bernie a substantial amount of money to invest. Bernie doesn’t have the investment acumen that he claims, so he simply deposits all of the money in his bank account. Some of the invested money is then returned to the first round of “investors” as profits from the investment, even though there has been no actual investment. The first round of investors are very impressed with the profits and the lack of risk, so they tell their friends. Those friends want in on the action, so they give Bernie money to invest. Bernie puts all of that money in his bank account as well. The money in the bank account accrues interest, and Bernie uses some of it to buy himself a house. At periodic intervals, Bernie uses the money that is in the bank account to pay out dividends to his “investors”, claiming that all of the money has come from his investments. Word of these low risk high value dividends starts to spread and more and more people want to invest. Bernie receives more money and throws it all into his bank account. He buys himself a second home and a couple of sports cars, continuing to pay out dividends. Things are going great for Bernie because there are always more people that want to invest. He is paying out dividends no matter how the stock market is doing, and his “investors” are impressed. Occasionally, someone will want their money back, but Bernie has enough money in the bank to cover it, and there are more people giving him money to invest, so he has no problem paying out. He’s feeling pretty good, and he buys his children homes as well. Then, unfortunately for Bernie, a recession hits and more of his clients suddenly need their money back. He has enough money to pay a few of them, but more and more people want money. When he can’t return it, the Ponzi scheme is uncovered, most people lose a lot of money, and Bernie goes to prison. This is a Ponzi scheme. Ponzi schemes must ultimately fail because there is not enough money in the bank account to return everyone’s money. They can only keep working as long as people pay money in. Once the supply of new investors dries up, their days are numbered, and the person that started the scheme will either abscond with all of the money or go to jail.

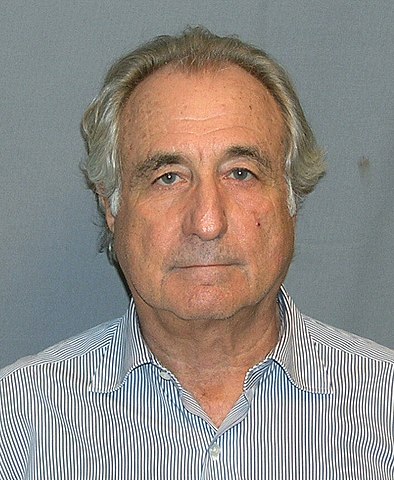

The most famous Ponzi scheme of all time is that created by Bernie Madoff. Over roughly 40 years, he managed to build an empire based on a Ponzi scheme, and when he was discovered, $65 billion was lost. A lot of that money came from wealthy individuals, but a lot also came from people who couldn’t afford the loss. Bernie Madoff was sentenced to 150 years in prison and ended up dying there.

That might be the largest Ponzi scheme of all time, but the most famous must surely be that of Charles Ponzi, because the scheme was named after him. In 1919, Ponzi was sent a letter from Spain with a prepaid envelope in it. The envelope didn’t have stamps, but came with a coupon to buy stamps, valued in American dollars. Ponzi realized that if he bought these coupons in countries where the value was low, such as Italy, he could then use them to buy stamps in a country where the value was high, such as the US, and then sell the stamps to get cash, making a profit. He set up a company to do just this and took investments from his friends. He promised them a return of 50% in 45 days and 100% in 90. Whether he intended to make a Ponzi scheme from the very beginning is impossible to know, but it very quickly became clear that buying the coupons, exchanging them for stamps, and then selling the stamps, would cost more in fees than he would make. Also, as he gained more investors, he would have needed millions of coupons, which he couldn’t get. He used his investors’ money to pay out the profits and his scheme continued to grow. He managed to turn away several investigations, but was finally found out and everything collapsed in August 1920. Many people lost all of their money and he brought down 5 different banks. It was such an enormous scheme, and it caused so much damage that the scheme became named after him. And this is what I learned today.

Try these:

Sources

https://en.wikipedia.org/wiki/Ponzi_scheme

https://en.wikipedia.org/wiki/Bernie_Madoff

https://en.wikipedia.org/wiki/Charles_Ponzi

https://www.investopedia.com/terms/p/ponzischeme.asp

https://www.investopedia.com/insights/what-is-a-pyramid-scheme

https://www.etymonline.com/word/scam

https://www.etymonline.com/word/con#etymonline_v_17297

https://www.etymonline.com/word/Ponzi%20scheme#etymonline_v_17636

https://moneysmart.gov.au/financial-scams/ponzi-schemes

https://www.bbc.com/news/articles/c140yjm5znzo

Image By U.S. Department of Justice – http://money.cnn.com/2009/03/16/news/madoff_assets/index.htm, Public Domain, https://commons.wikimedia.org/w/index.php?curid=6270525

Pingback: What is a hedge fund?