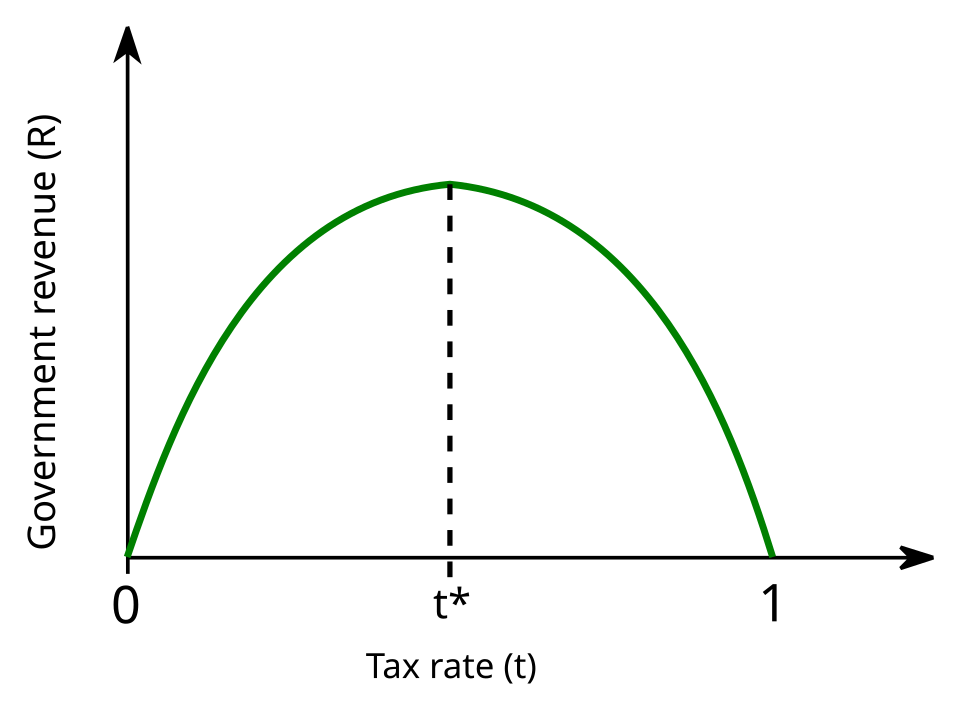

What is the Laffer Curve? The Laffer Curve is a graph that shows the theoretical relationship between the amount people are taxed and the amount of revenue the government can expect to get. The amount of revenue is zero when people are taxed 0% or 100% of their income, and it rises to an optimal point somewhere in the middle.

The Laffer Curve is named after an American economist called Arthur Laffer, although he says that he did not come up with the idea. He sketched it on a napkin in a meeting with Dick Cheney and Donald Rumsfeld in 1974. A journalist was present at the meeting, and he wrote an article about it, calling the graph the “Laffer Curve”. Arthur Laffer said that he was just summarizing economic theories that were developed long before his time. Still, his curve was very visually appealing, and it was one of the arguments that led Ronald Reagan to cut taxes.

The theory is fairly simple to understand. If the government cuts taxes to zero, then obviously, there will be no tax revenue. People would be happy until all of the public services, such as hospitals, schools, and roads, stopped working. On the other hand, if tax is raised to 100%, the government would also not receive any income because people would have no incentive to work or would leave the country. That is, unless everything becomes free, which is not really possible. There is a magic point on the graph, which is the top of the curve, where tax is at just the right percentage to balance out these two halves. The government gets its maximum revenue, but people are still incentivized to work. Working out where this peak on the curve sits is a constant and ongoing economic problem for governments. It also depends very highly on culture. For example, the peak on the Laffer Curve is far higher in Finland, for example, than it is in the UK.

The Laffer Curve is a very simplistic way of looking at taxes and there are many factors that need to be considered. The first is that a flat tax rate across society doesn’t work because taxing a billionaire 30% and a low-income worker 30% can have vastly different outcomes. There are different Laffer Curves for each income bracket in society, and it is very difficult to find all of them. It also depends on trust in the government. The Organization for Economic Cooperation and Development (OECD) looks at the level of trust people have in all governments around the world. At the top are Switzerland, Luxembourg, Finland, Ireland, Norway, and Denmark. At the bottom of the list are the USA, Colombia, and Slovakia. (It isn’t an exhaustive list of all countries, and years vary.) Not surprisingly, tax rates in the countries with higher levels of government trust tend to be higher than those in countries with lower government trust. People are willing to pay more because they can see the results of the tax they are paying. The Laffer Curves in these countries would be very different.

Working out how much tax people should pay is not a new problem. People have been paying taxes for over 5,000 years. Some of the earliest records of tax come from ancient Egypt. At the time, Egypt didn’t have a system of money, and people paid taxes with the produce they had grown or their labor. Advisors of the pharaoh traveled the country every year, assessing the value of livestock owned by individuals. An amount of grain had to be paid as a tax on that livestock. If people didn’t have livestock or grain, they paid with their labor. Great buildings, such as the Pyramids at Giza, were partially built using labor as a form of tax. The Rosetta stone, which was used to translate ancient Egyptian, had a lot of tax information on it as well. The kingdom of Sumer also taxed people, but the proceeds went to temples rather than the government. A lot of the standardized taxes that we have today came about because of the Romans. They came up with a sales tax and a wealth-based income tax. European powers came up with more ways to get money out of their subjects to finance their building projects and wars. The Domesday Book in England was a way to work out how much land people owned so that they could be effectively taxed. Since then, systems of taxation have slowly become more complicated. The Laffer Curve is very useful, but working out where the peak sits is very complicated. And this is what I learned today.

Sources

https://www.investopedia.com/terms/l/laffercurve.asp

https://www.socialeurope.eu/after-the-laffer-curve-taxing-the-rich-at-last

https://en.wikipedia.org/wiki/Laffer_curve

https://en.wikipedia.org/wiki/Arthur_Laffer

https://worldpopulationreview.com/country-rankings/trust-in-government-by-country

Image By Bastianowa – This file was derived from:Krzywa Laffera.svg:Laffer Curve.png:, CC BY-SA 2.5, https://commons.wikimedia.org/w/index.php?curid=117585270